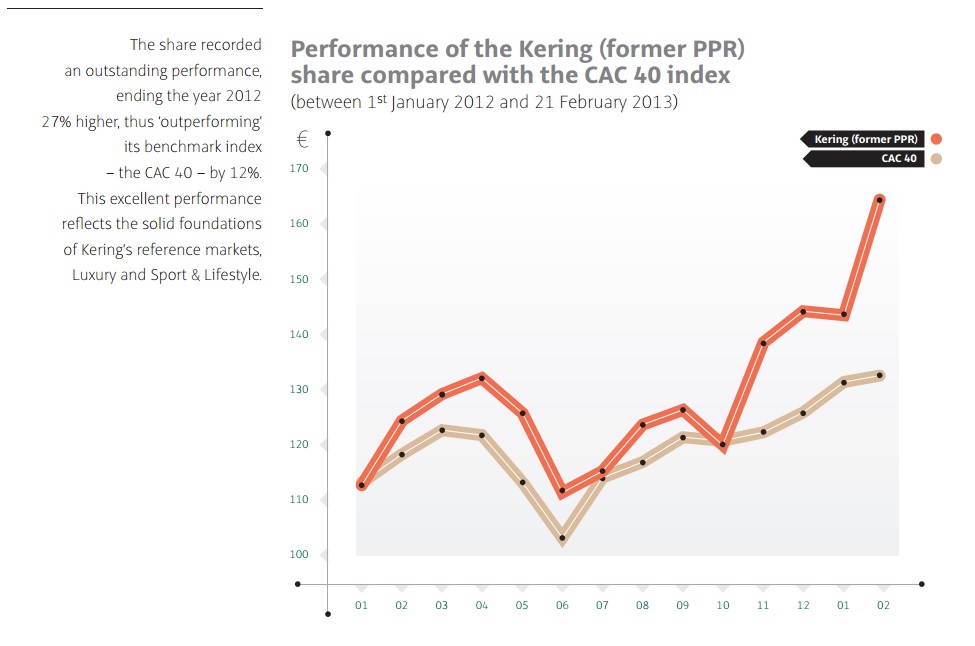

Today is the second and last day of the Sustainable Brands conference in 'the City'. Promoted by a number of brands that have a lot to earn from a focus on sustainability the forum was organized to spurr brands to penetrate even further into peoples lives. On the first day all speakers (mainly research organizations living of the same brands in some ways) pointed to the enormous opportunities that lie in sustainable branding. However, most data showed the economic value of considering consumers value. Over night consumers become customers whose personal lives offer great 'mining' opportunites to get to know their desires and ambitions, that apparantly are increasingly green and global conscious. However, as HAVAS Media showed in their presentation, companies that take this consumers desire to change the world more serious are more likely to produce positive numbers in terms of the values of shares (a 20% benefit compared to other market performers). The Kering group (pronounce 'caring') providing the example on the spot. The group binds together a number of high profile brands in consumer luxury goods (expensive watches, sports and leisure equipment and the like). You just start wondering: what is it that these companies have in mind when they take sustainability so serious. The people or the planet? It was a bit hilarious though to find sustainability guru John Elkington, first declaring his commitment to the company (sitting in the Sustainability Technical Working Group of Kering and most probably one of the master minds behind the rebranding of Kering) and subsequently interviewing Marie-Claire Daveu, Chief Sustainability officer and the Head of International Institutional Affairs at Kering. Between the lines John pointed to the fact that the majority of the shares of Kering were in the posession of the French family. Allowing for much more flexibility to take a longer term perspective compared to those who are fully 'market owned' makes such companies the perfect fit to partner in Elkingtons breakthrough capitalism and getting to zero gospel proclaimed through his company Volans.

However, what is so profane in this gospel is the contrast between the professed zero-growth agenda and the obsession with the value of market shares as a main motivator for greening the economy. It was mentioned that the same morning a new benchmarking exercise was introduced at the London Stock Exchange keeping track of the number of companies with a 'green' profile listed at the stock exchange world-wide. However, was it not exactly the ill-design of the way our stock markets function (based on expected future value rather then todays economic value), that caused our economies to crash? I cannot see how tracking the 'greening' of the stock market will bring us a change in mindset away from a profit focus onto a path of sustainability. I am afraid that the "Dream to Transform Desire" remains just a Dream in A Black Box and will ultimately continue to feed the beast of greed. Comments are closed.

|

About meMy name is Reinier van Hoffen. U®Reading

Click here for a summary.

Also find the text of a lecture Dr. Achterhuis held at the 2012 Bilderberg conference. Archives

August 2022

|

AddressNachtegaallaan 26

Ede, the Netherlands |

Telephone+31 (0)6 1429 1569

|

|

RSS Feed

RSS Feed